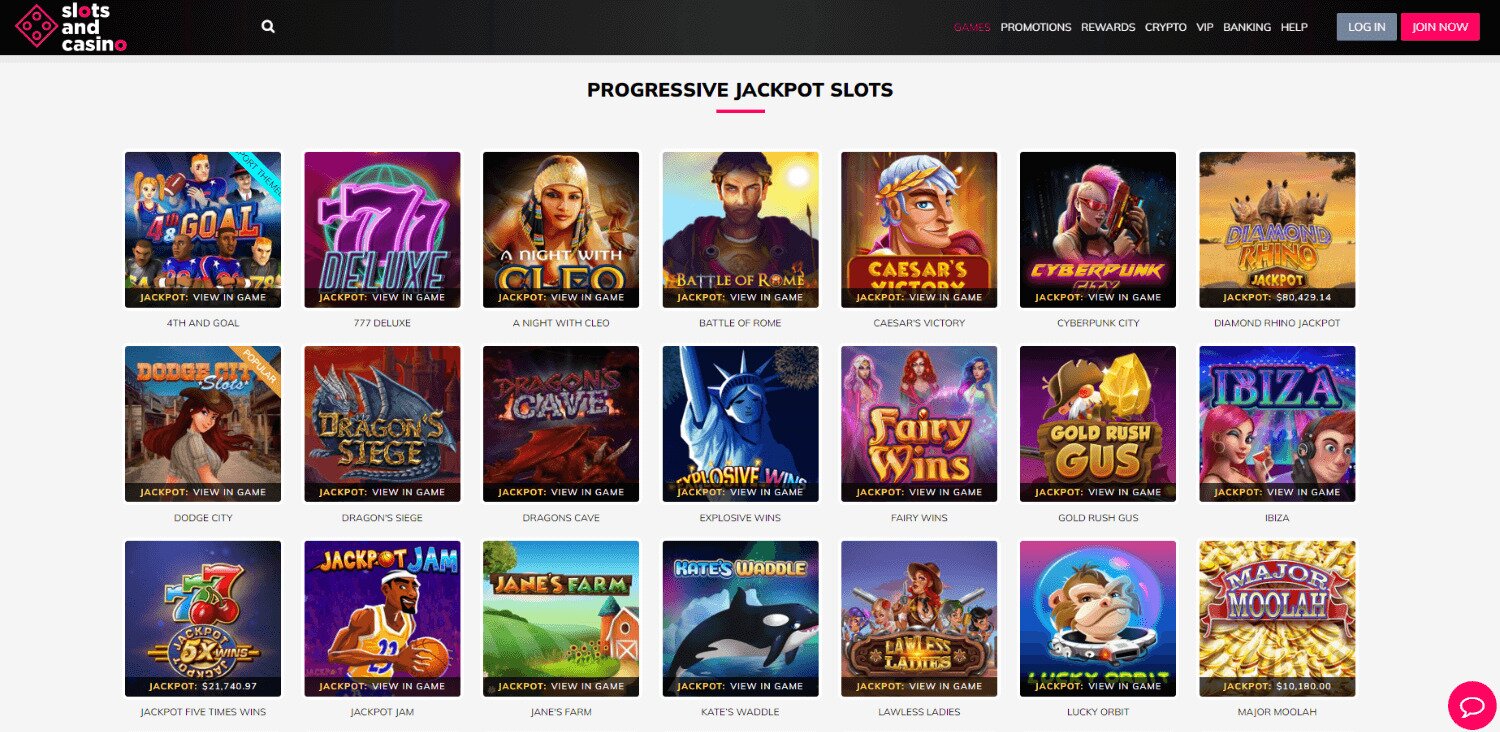

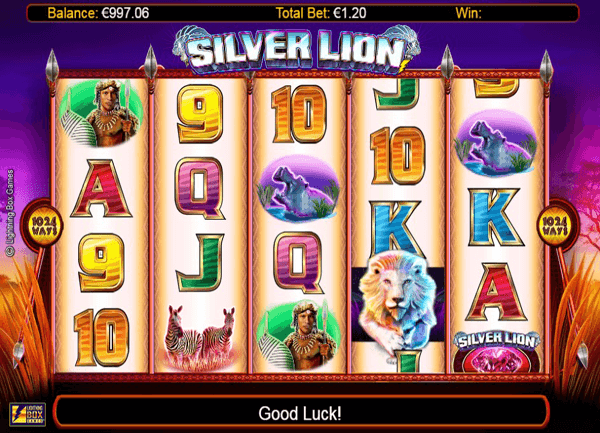

Mengetahui dan memahami teknik-teknik yang tepat untuk bermain slot online bisa menjadi keuntungan besar bagi para pecinta perjudian. Salah satu varian slot yang sedang mendapatkan perhatian cukup besar adalah demo slot gacor MAXWIN. Dengan berbagai keajaiban yang ditawarkannya, demo slot gacor MAXWIN menjadi primadona di kalangan pemain slot.

Bagi Anda yang tertarik untuk mencoba keajaiban dari demo slot gacor MAXWIN, sangat penting untuk memiliki akun slot gacor MAXWIN terlebih dahulu. Dengan memiliki akun tersebut, Anda dapat mengakses berbagai fitur menarik yang ada dalam demo slot gacor MAXWIN. Tidak hanya itu, memiliki akun juga memungkinkan Anda untuk mendapatkan berbagai bonus dan promosi menarik yang ditawarkan oleh penyedia slot online.

Untuk dapat bermain demo slot gacor MAXWIN, Anda juga perlu menemukan link slot gacor MAXWIN yang valid. Link tersebut akan membawa Anda langsung ke situs resmi penyedia demo slot gacor MAXWIN, di mana Anda dapat menikmati permainan dengan lancar dan aman. Penting untuk selalu mencari link yang terpercaya, agar dapat menghindari risiko penipuan atau malware yang dapat membahayakan perangkat Anda.

Bagi yang tertarik untuk bergabung dan mencoba demo slot gacor MAXWIN, Anda harus terlebih dahulu mendaftar akun slot tersebut. Proses pendaftaran sangatlah mudah dan cepat. Anda hanya perlu mengisi formulir pendaftaran dengan data diri yang valid, dan Anda sudah siap untuk memulai petualangan mengungkap keajaiban dari demo slot gacor MAXWIN.

Demikianlah sedikit gambaran mengenai demo slot gacor MAXWIN, dengan fitur-fitur menariknya dan keajaiban yang bisa Anda temukan. Miliki akun slot gacor MAXWIN, temukan link slot gacor yang valid, dan daftar sekarang juga agar Anda tidak melewatkan kesempatan untuk merasakan sensasi bermain demo slot gacor MAXWIN yang memukau. Selamat bermain dan semoga mendapatkan kemenangan yang besar!

Akun Slot Gacor MAXWIN

Banyak pecinta judi online yang ingin merasakan sensasi bermain slot gacor di MAXWIN. Untuk bisa menikmati keajaiban demo slot gacor MAXWIN, Anda perlu memiliki akun di platform tersebut. Dalam artikel ini, kami akan memberikan panduan lengkap tentang cara membuat akun slot gacor MAXWIN yang dapat membantu Anda memulai perjalanan bermain slot yang menarik.

Pertama-tama, Anda perlu mengunjungi situs resmi MAXWIN. Pada halaman utama, carilah tombol "Daftar" atau "Registrasi" yang biasanya terletak di sudut kanan atas halaman. Klik tombol tersebut untuk melanjutkan.

Setelah mengklik tombol, Anda akan diarahkan ke halaman pendaftaran. Di sini, Anda perlu mengisi formulir pendaftaran dengan informasi pribadi yang diperlukan. Pastikan untuk mengisi data secara akurat dan tepat agar proses verifikasi dapat dilakukan dengan lancar.

Setelah mengisi formulir pendaftaran, klik tombol "Daftar" atau "Register" untuk menyelesaikan proses pendaftaran akun slot gacor MAXWIN. Biasanya, Anda akan menerima email konfirmasi yang berisi instruksi lanjutan untuk mengaktifkan akun Anda.

Dengan memiliki akun slot gacor MAXWIN, Anda dapat menjelajahi berbagai macam permainan slot yang menarik. Pastikan untuk menjaga kerahasiaan data login Anda dan menikmati pengalaman bermain yang seru di platform MAXWIN.

Link Slot Gacor MAXWIN

Apabila Anda tertarik untuk mencoba keajaiban demo slot gacor MAXWIN, Anda perlu memiliki akun slot gacor MAXWIN terlebih dahulu. Untuk mendaftar, Anda dapat mengikuti langkah-langkah berikut:

- Buka halaman resmi MAXWIN melalui browser di perangkat Anda.

- Pada halaman utama, temukan dan klik tombol "Daftar" atau "Register" yang biasanya terletak di pojok kanan atas layar.

- Setelah itu, Anda akan dibawa ke halaman pendaftaran. Isilah formulir pendaftaran dengan data yang valid dan benar, seperti nama lengkap, alamat email, nomor telepon, dan lain-lain.

- Jika ada kolom atau pilihan yang perlu Anda centang atau isi seperti "Saya telah membaca dan menyetujui syarat dan ketentuan", pastikan untuk melakukannya.

- Setelah semua data terisi dengan benar, klik tombol "Daftar" atau "Register" untuk mengirimkan formulir pendaftaran Anda.

Dengan mendaftar dan memiliki akun slot gacor MAXWIN, Anda akan dapat mengakses demo slot gacor MAXWIN dan merasakan sendiri keajaibannya. slot terpercaya Jangan lewatkan kesempatan ini dan rasakan pengalaman bermain slot yang seru dan menguntungkan!

Cara Daftar Slot Gacor MAXWIN

Untuk mulai bermain di slot gacor MAXWIN, Anda perlu membuat akun terlebih dahulu. Berikut adalah langkah-langkah cara daftar slot gacor MAXWIN:

-

Kunjungi situs resmi MAXWIN. Anda dapat menemukan link situs ini melalui mesin pencari favorit Anda.

-

Setelah Anda masuk ke halaman utama situs MAXWIN, cari tautan "Daftar" atau "Registrasi" yang biasanya terletak di sudut kanan atas halaman.

-

Klik tautan tersebut untuk membuka halaman pendaftaran. Isilah formulir pendaftaran dengan informasi yang diminta, seperti nama lengkap, alamat email, kata sandi, dan nomor telepon. Pastikan informasi yang Anda berikan akurat dan valid.

-

Setelah mengisi formulir pendaftaran, klik tombol "Daftar" atau "Submit" untuk mengirimkan permohonan pendaftaran Anda. Tunggu beberapa saat hingga proses verifikasi selesai.

-

Buka email Anda dan periksa kotak masuk atau folder spam untuk menemukan email konfirmasi dari MAXWIN. Klik tautan konfirmasi yang terdapat dalam email tersebut untuk mengaktifkan akun Anda.

Selamat! Sekarang Anda telah berhasil mendaftar dan memiliki akun slot gacor MAXWIN. Anda dapat menggunakan akun tersebut untuk login ke situs MAXWIN dan mulai menikmati berbagai permainan slot yang tersedia. Jangan lupa untuk mematuhi aturan dan kebijakan yang berlaku di situs tersebut.